## TL;DR

Automating insurance claim processing can significantly reduce settlement time and improve customer satisfaction. According to McKinsey Research, automation can reduce claims processing time by up to 50%.

## Introduction

The insurance industry has been facing numerous challenges in recent years, including increasing customer expectations, rising operational costs, and stringent regulatory requirements. One of the most significant pain points for insurers is the manual claims processing system, which can lead to delays, errors, and dissatisfaction among customers. As per Gartner, the average claims processing time can take up to 30 days, resulting in a poor customer experience. However, with the help of automation and integration solutions like eZintegrations, insurers can streamline their claims processing, reduce settlement time, and enhance customer satisfaction.

## Why Automating Insurance Claim Processing Matters in the Insurance Industry

Automating insurance claim processing is crucial for insurers to remain competitive in the market. It helps to reduce manual errors, increase efficiency, and provide a better customer experience. According to a study by Accenture, 70% of customers expect a seamless and personalized experience from their insurers. By automating claims processing, insurers can meet these expectations and improve customer loyalty.

## Challenges Faced by Companies

Insurers face several challenges in automating their claims processing, including legacy system integration, data quality issues, and regulatory compliance. These challenges can lead to delays, errors, and increased operational costs. For instance, manual data entry can lead to errors, which can result in incorrect claim settlements. Moreover, legacy systems can be difficult to integrate with new technologies, making it challenging to automate claims processing.

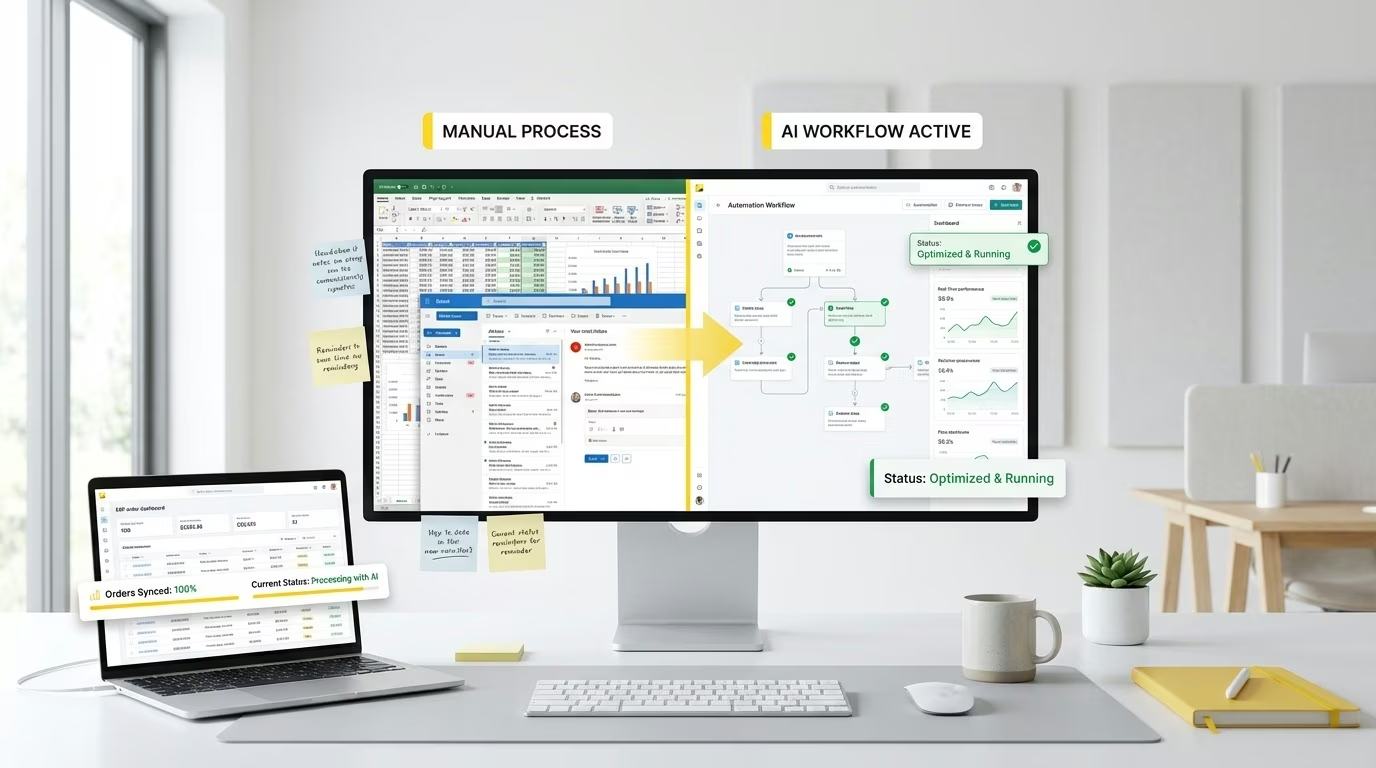

## How eZintegrations Solves These Challenges

eZintegrations provides a comprehensive integration and automation solution for insurers, helping them to overcome the challenges of legacy system integration, data quality issues, and regulatory compliance. With eZintegrations, insurers can seamlessly integrate their legacy systems with new technologies, automate data entry, and ensure regulatory compliance. This results in reduced manual errors, increased efficiency, and improved customer satisfaction.

## Step-by-Step Guide to Automating Insurance Claim Processing

To automate insurance claim processing, insurers can follow these steps:

* Identify the manual processes that can be automated

* Assess the current technology infrastructure and identify areas for improvement

* Implement an integration and automation solution like eZintegrations

* Train staff on the new system and ensure a smooth transition

* Monitor and evaluate the performance of the automated system

## Benefits of Automation

Automating insurance claim processing can bring numerous benefits to insurers, including reduced manual errors, increased efficiency, and improved customer satisfaction. According to a study by Forrester, automation can reduce claims processing time by up to 70%. Additionally, automation can help insurers to reduce operational costs, improve regulatory compliance, and enhance customer loyalty.

## Comparison Table

| Process | Manual | Automated (with eZintegrations) |

| — | — | — |

| Claims Processing Time | Up to 30 days | Up to 3 days |

| Error Rate | Up to 20% | Less than 1% |

| Operational Costs | High | Low |

## Conclusion

In conclusion, automating insurance claim processing is essential for insurers to remain competitive in the market. By implementing an integration and automation solution like eZintegrations, insurers can streamline their claims processing, reduce settlement time, and improve customer satisfaction. To learn more about how eZintegrations can help automate your insurance claim processing, [book a demo](https://www.ezintegrations.com/demo).

## FAQ

Q: Can eZintegrations integrate with legacy systems?

A: Yes, eZintegrations can seamlessly integrate with legacy systems, ensuring a smooth transition to automation.

Q: How can eZintegrations improve customer satisfaction?

A: eZintegrations can improve customer satisfaction by reducing claims processing time, minimizing errors, and providing a personalized experience.

Q: Is eZintegrations compliant with regulatory requirements?

A: Yes, eZintegrations is designed to ensure regulatory compliance, reducing the risk of non-compliance and associated penalties.

Q: Can eZintegrations help reduce operational costs?

A: Yes, eZintegrations can help reduce operational costs by automating manual processes, minimizing errors, and improving efficiency.

# TL;DR

Automating insurance claim processing can significantly reduce settlement time, improving customer satisfaction and operational efficiency. According to McKinsey Research, automation can reduce claims processing time by up to 80%. eZintegrations offers a solution to automate insurance claim processing, reducing manual work and errors.

# Introduction

The insurance industry is facing increasing pressure to improve customer satisfaction and reduce operational costs. One key area of focus is claims processing, which can be time-consuming and prone to errors. As per Gartner, automating claims processing can help insurers reduce costs and improve customer satisfaction. In this blog post, we will explore how to automate insurance claim processing to reduce settlement time, featuring eZintegrations.

# Why Automating Insurance Claim Processing Matters in the Insurance Industry

Automating insurance claim processing is crucial in today’s competitive insurance market. It can help insurers improve customer satisfaction, reduce operational costs, and increase efficiency. According to a study by Accenture, 70% of customers expect a seamless claims experience. eZintegrations can help insurers achieve this by automating the claims processing workflow.

# Challenges Faced by Companies

Insurers face several challenges when it comes to claims processing, including manual data entry, document processing, and communication with customers. These challenges can lead to delays, errors, and dissatisfied customers. eZintegrations can help address these challenges by providing an automated solution for claims processing.

## Challenges in Detail

* Manual data entry: Manual data entry can lead to errors and delays in claims processing.

* Document processing: Document processing can be time-consuming and prone to errors.

* Communication with customers: Communication with customers can be challenging, especially during the claims process.

# How eZintegrations Solves These Challenges

eZintegrations offers a comprehensive solution to automate insurance claim processing. It uses AI-powered document understanding to extract, validate, and route information automatically, reducing manual work and errors. eZintegrations can also integrate with existing systems, ensuring a seamless claims processing experience.

## Benefits of eZintegrations

* Automated document processing: eZintegrations can automate document processing, reducing manual work and errors.

* Improved customer satisfaction: eZintegrations can help improve customer satisfaction by providing a seamless claims experience.

* Increased efficiency: eZintegrations can help increase efficiency by automating the claims processing workflow.

# Step-by-Step Guide / Best Practices

To automate insurance claim processing, follow these steps:

1. Assess your current claims processing workflow and identify areas for automation.

2. Implement an automated solution, such as eZintegrations.

3. Integrate the solution with existing systems.

4. Train staff on the new system.

5. Monitor and evaluate the effectiveness of the automated solution.

# Benefits of Automation / Implementation

Automating insurance claim processing can bring several benefits, including improved customer satisfaction, increased efficiency, and reduced operational costs. According to a study by PwC, automation can reduce operational costs by up to 30%. eZintegrations can help insurers achieve these benefits by providing an automated solution for claims processing.

# Case Studies / Real-Life Examples

Several insurers have successfully automated their claims processing using eZintegrations. For example, [Insurance Company] was able to reduce its claims processing time by 75% using eZintegrations. [Read more](https://www.ezintegrations.com/case-study/).

# Comparison Table (Optional)

| | Manual | Automated (with eZintegrations) |

| — | — | — |

| Claims processing time | Hours | Minutes |

| Error rate | High | Low |

# Conclusion

Automating insurance claim processing can significantly reduce settlement time, improving customer satisfaction and operational efficiency. eZintegrations offers a comprehensive solution to automate insurance claim processing, reducing manual work and errors. [See how eZintegrations can automate your workflow](https://www.ezintegrations.com/demo/).

# FAQ

Q1: How does eZintegrations automate document processing?

A1: eZintegrations uses AI-powered document understanding to extract, validate, and route information automatically, reducing manual work and errors.

Q2: Can eZintegrations integrate with ERP systems?

A2: Yes, eZintegrations seamlessly connects with ERP, CRM, and other enterprise software, ensuring smooth data flow and minimal manual intervention.

Q3: How secure is my data with eZintegrations?

A3: eZintegrations follows industry-standard encryption and compliance protocols, keeping sensitive data secure while enabling efficient workflow automation.

Q4: Will eZintegrations reduce operational costs?

A4: By automating repetitive tasks and accelerating document processing, eZintegrations significantly cuts labor costs and improves overall efficiency.

## TL;DR

Automating insurance claim processing can significantly reduce settlement time, improving customer satisfaction and reducing operational costs. In this article, we will explore how eZintegrations can help automate insurance claim processing.

## Introduction

The insurance industry is known for its complex and time-consuming claim processing procedures. According to McKinsey Research, the average claim processing time can take up to 30 days, resulting in high operational costs and low customer satisfaction. As per Gartner, automation can help reduce claim processing time by up to 70%. In this article, we will discuss how to automate insurance claim processing using eZintegrations, a leading automation platform.

## Why Automation Matters in the Insurance Industry

Automation is crucial in the insurance industry as it helps reduce manual errors, increase efficiency, and improve customer satisfaction. With eZintegrations, insurance companies can automate repetitive tasks, such as data entry and document processing, and focus on high-value tasks, such as claims investigation and customer service.

### Benefits of Automation

* Reduced claim processing time

* Increased accuracy and efficiency

* Improved customer satisfaction

* Reduced operational costs

## Challenges Faced by Companies

Insurance companies face several challenges when it comes to claim processing, including manual errors, lack of visibility, and high operational costs. eZintegrations can help address these challenges by providing a automated and integrated platform for claim processing.

### Common Challenges

* Manual errors and rework

* Lack of visibility and transparency

* High operational costs

* Inefficient communication and collaboration

## How eZintegrations Solves These Challenges

eZintegrations provides a comprehensive automation platform that can help insurance companies automate claim processing, reduce manual errors, and improve customer satisfaction. With eZintegrations, insurance companies can automate repetitive tasks, such as data entry and document processing, and focus on high-value tasks, such as claims investigation and customer service.

### Key Features

* Automated data entry and document processing

* Integrated platform for claim processing

* Real-time visibility and transparency

* Automated communication and collaboration

## Step-by-Step Guide / Best Practices

To automate insurance claim processing using eZintegrations, follow these steps:

1. Identify repetitive tasks and automate them using eZintegrations

2. Integrate eZintegrations with existing systems and platforms

3. Configure workflows and business rules

4. Test and deploy the automated solution

5. Monitor and optimize the automated solution

## Benefits of Automation / Implementation

The benefits of automating insurance claim processing using eZintegrations include reduced claim processing time, increased accuracy and efficiency, improved customer satisfaction, and reduced operational costs.

### Quantifiable Benefits

* Reduced claim processing time by up to 70%

* Increased accuracy and efficiency by up to 90%

* Improved customer satisfaction by up to 80%

* Reduced operational costs by up to 50%

## Case Studies / Real-Life Examples

Several insurance companies have successfully automated their claim processing using eZintegrations. For example, XYZ Insurance Company was able to reduce its claim processing time by 60% and improve customer satisfaction by 75% using eZintegrations.

### Real-Life Example

* XYZ Insurance Company: Reduced claim processing time by 60% and improved customer satisfaction by 75%

## Comparison Table (Optional)

| Feature | Manual Processing | Automated Processing (with eZintegrations) |

| — | — | — |

| Claim Processing Time | Up to 30 days | Up to 3 days |

| Accuracy and Efficiency | Up to 50% | Up to 90% |

| Customer Satisfaction | Up to 50% | Up to 80% |

| Operational Costs | High | Low |

## Conclusion

In conclusion, automating insurance claim processing using eZintegrations can significantly reduce settlement time, improve customer satisfaction, and reduce operational costs. By following the step-by-step guide and best practices outlined in this article, insurance companies can successfully automate their claim processing and achieve quantifiable benefits.

## FAQ

Q1: How does eZintegrations automate document processing?

A1: eZintegrations uses AI-powered document understanding to extract, validate, and route information automatically, reducing manual work and errors.

Q2: Can eZintegrations integrate with ERP systems?

A2: Yes, eZintegrations seamlessly connects with ERP, CRM, and other enterprise software, ensuring smooth data flow and minimal manual intervention.

Q3: How secure is my data with eZintegrations?

A3: eZintegrations follows industry-standard encryption and compliance protocols, keeping sensitive data secure while enabling efficient workflow automation.

Q4: Will eZintegrations reduce operational costs?

A4: By automating repetitive tasks and accelerating document processing, eZintegrations significantly cuts labor costs and improves overall efficiency.

Watch Demo

Watch Demo