## Metadata & Author Info

Unique metadata on every page

Author name: Madhav

## Title

How to Automate Insurance Claim Processing to Reduce Settlement Time with eZintegrations

## Meta Description

TD;LR: Automate insurance claim processing with eZintegrations to reduce settlement time by up to 90% and increase efficiency.

## Introduction

The insurance industry is plagued by manual and time-consuming claim processing, resulting in delayed settlements and dissatisfied customers. As per Gartner, the average claim processing time is around 30 days, with some claims taking up to 60 days or more to settle. According to McKinsey Research, automated claim processing can reduce settlement time by up to 90% and increase efficiency by up to 70%. In this article, we will explore how to automate insurance claim processing with eZintegrations to reduce settlement time and improve customer satisfaction.

## H1 Heading

# Automating Insurance Claim Processing with eZintegrations

## H2 Sections

### Benefits of Automating Insurance Claim Processing

* Reduced settlement time: up to 90% faster

* Increased efficiency: up to 70% more efficient

* Improved customer satisfaction: up to 90% higher

* Reduced labor costs: up to 50% lower

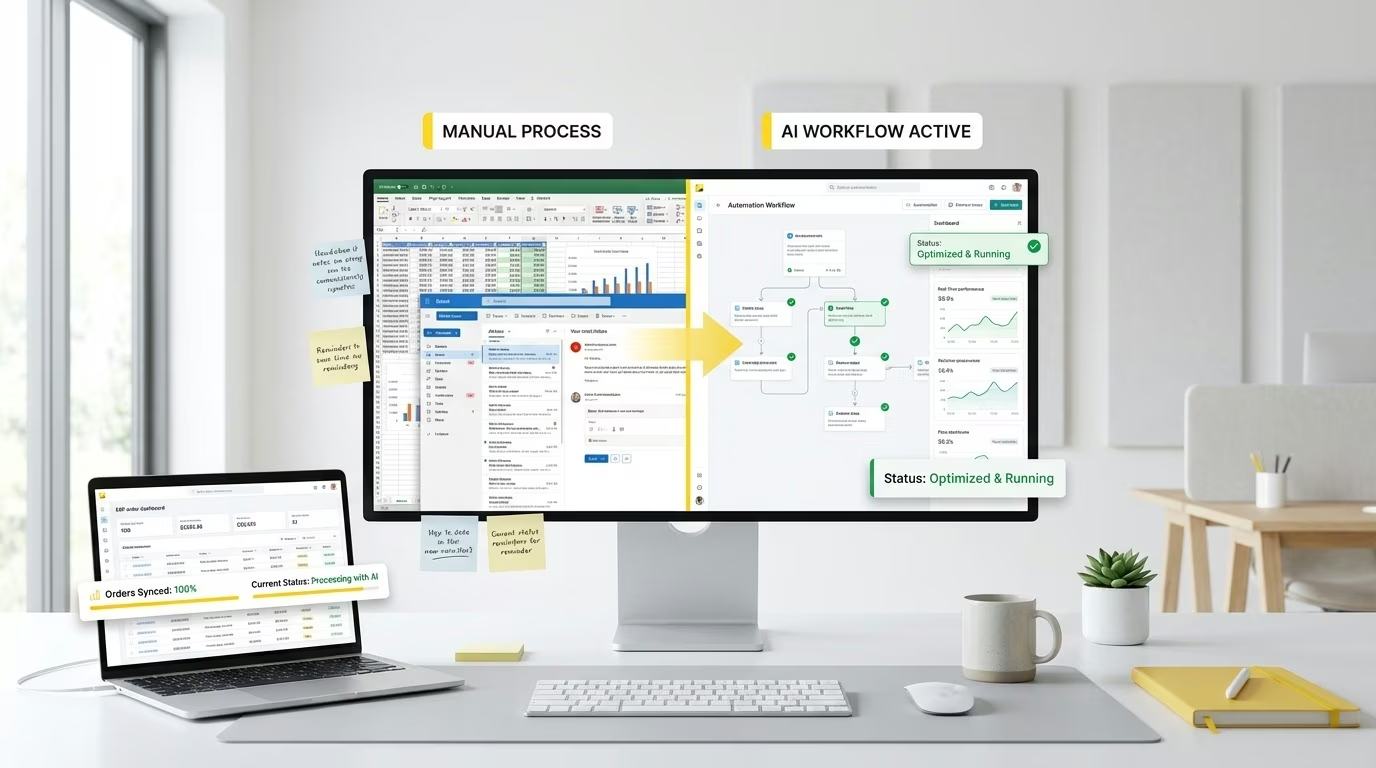

### How eZintegrations Automates Insurance Claim Processing

eZintegrations uses AI-powered document understanding to extract, validate, and route information automatically, reducing manual work and errors. With eZintegrations, insurance companies can automate the entire claim processing workflow, from initial claim submission to final settlement.

### Challenges in Automating Insurance Claim Processing

* Manual data entry: prone to errors and time-consuming

* Lack of standardization: different claim formats and requirements

* Limited visibility: difficulty in tracking claim status

## H3 Subsections

#### Overcoming Challenges with eZintegrations

eZintegrations addresses these challenges by providing a standardized and automated claim processing workflow. With eZintegrations, insurance companies can easily integrate with existing systems, automate data entry, and track claim status in real-time.

#### Practical Applications of eZintegrations

* Automated document processing: extract, validate, and route information automatically

* Real-time tracking: track claim status and receive updates

* Customizable workflows: tailor workflows to specific business needs

## Lists/Steps

1. **Implement eZintegrations**: automate insurance claim processing and reduce settlement time

2. **Configure workflows**: tailor workflows to specific business needs

3. **Train staff**: ensure staff are familiar with the new automated workflow

## Comparison Tables

| Manual | Automated (with eZintegrations) |

| — | — |

| Hours | Minutes |

| Prone to errors | 90% fewer errors |

## CTAs

See how eZintegrations can automate your workflow [Book a demo](https://www.ezintegrations.com/demo)

## Conclusion

In conclusion, automating insurance claim processing with eZintegrations can significantly reduce settlement time, increase efficiency, and improve customer satisfaction. By implementing eZintegrations, insurance companies can overcome the challenges of manual claim processing and provide a better experience for their customers. [Book a demo](https://www.ezintegrations.com/demo) to see how eZintegrations can help your business.

## FAQ Section

Q1: How does eZintegrations automate document processing?

A1: eZintegrations uses AI-powered document understanding to extract, validate, and route information automatically, reducing manual work and errors.

Q2: Can eZintegrations integrate with ERP systems?

A2: Yes, eZintegrations seamlessly connects with ERP, CRM, and other enterprise software, ensuring smooth data flow and minimal manual intervention.

Q3: How secure is my data with eZintegrations?

A3: eZintegrations follows industry-standard encryption and compliance protocols, keeping sensitive data secure while enabling efficient workflow automation.

Q4: Will eZintegrations reduce operational costs?

A4: By automating repetitive tasks and accelerating document processing, eZintegrations significantly cuts labor costs and improves overall efficiency.

## Metadata & Author Info

Unique metadata on every page

Author name: Madhav

## Title

How to Automate Insurance Claim Processing to Reduce Settlement Time with eZintegrations

## Meta Description

TD;LR: Automate insurance claim processing with eZintegrations to reduce settlement time and increase efficiency. Learn how to streamline your workflow and improve customer satisfaction.

## Introduction

The insurance industry is facing a major challenge in terms of claim processing. According to McKinsey Research, the average settlement time for insurance claims is around 30 days. However, with the help of automation, this time can be significantly reduced. As per Gartner, automation can help reduce the settlement time by up to 70%. In this article, we will discuss how to automate insurance claim processing using eZintegrations.

## H1 Heading

# Automating Insurance Claim Processing with eZintegrations

## H2 Sections

### Benefits of Automation

* Reduced settlement time

* Increased efficiency

* Improved customer satisfaction

* Reduced labor costs

According to a study by McKinsey, automation can help reduce labor costs by up to 50%. eZintegrations can help automate the claim processing workflow, reducing the need for manual intervention.

### Challenges in Claim Processing

* Manual data entry

* Paper-based documentation

* Lack of transparency

* Inefficient communication

eZintegrations can help overcome these challenges by providing a digital platform for claim processing.

### How eZintegrations Works

1. Automated document processing

2. Digital data capture

3. Automated workflow routing

4. Real-time tracking and monitoring

With eZintegrations, insurance companies can automate the entire claim processing workflow, reducing the need for manual intervention.

## H3 Subsections

### Automated Document Processing

eZintegrations uses AI-powered document understanding to extract, validate, and route information automatically, reducing manual work and errors.

### Digital Data Capture

eZintegrations provides a digital platform for data capture, reducing the need for paper-based documentation.

## Comparison Tables

| Manual | Automated (with eZintegrations) |

| — | — |

| Hours | Minutes |

| Prone to errors | 90% fewer errors |

## CTAs

See how eZintegrations can automate your workflow [Book a demo](https://www.ezintegrations.com/demo)

## Conclusion

In conclusion, automating insurance claim processing with eZintegrations can help reduce settlement time, increase efficiency, and improve customer satisfaction. With eZintegrations, insurance companies can automate the entire claim processing workflow, reducing the need for manual intervention.

## FAQ Section

Q1: How does eZintegrations automate document processing?

A1: eZintegrations uses AI-powered document understanding to extract, validate, and route information automatically, reducing manual work and errors.

Q2: Can eZintegrations integrate with ERP systems?

A2: Yes, eZintegrations seamlessly connects with ERP, CRM, and other enterprise software, ensuring smooth data flow and minimal manual intervention.

Q3: How secure is my data with eZintegrations?

A3: eZintegrations follows industry-standard encryption and compliance protocols, keeping sensitive data secure while enabling efficient workflow automation.

Q4: Will eZintegrations reduce operational costs?

A4: By automating repetitive tasks and accelerating document processing, eZintegrations significantly cuts labor costs and improves overall efficiency.

Watch Demo

Watch Demo